Introduction to the Different Types of Income

Most people focus on how much they earn, but do not always understand how they earn it. Income can come from various sources—some require your direct involvement, while others generate money in the background. Understanding different types of income helps you manage your finances, make better investment decisions, and save on taxes.

This article explores the major types of income, provides real-life examples, and explains how each contributes to your financial well-being.

Table of Contents

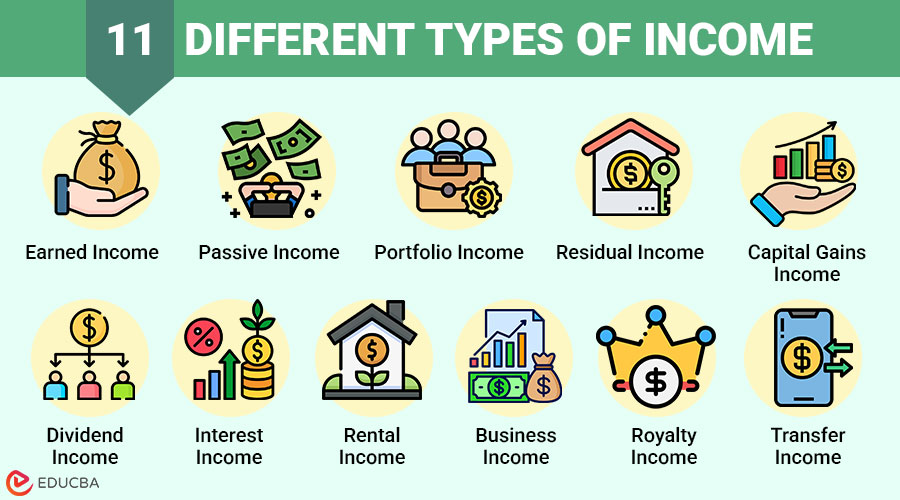

Top 11 Types of Income

Here are the 11 major types of income that can help you build financial security and independence:

#1. Earned Income (Active Income)

Earned income is money you receive by actively working, either as an employee or through self-employment. It requires your time, effort, and skills.

Examples:

- Full-time job: A software engineer earns ₹10,00,000 annually through salary.

- Freelancing: A graphic designer earns by taking up client projects online.

- Business owner (active): A bakery owner who manages daily operations earns income through daily sales.

Advantages:

- Predictable and steady cash flow.

- Easier to qualify for loans or credit based on salary slips or income tax returns.

Limitations:

- Directly linked to time—if you stop working, the income stops.

- High taxes in many countries are due to progressive tax systems.

#2. Passive Income

You earn passive income from activities or investments that need little ongoing effort after the initial setup and investment.

Examples:

- Rental properties: Buying an apartment and renting it out monthly.

- YouTube channel: Earning ad revenue from old videos.

- Dropshipping or affiliate marketing: Automated online businesses earn without day-to-day involvement.

Advantages:

- Frees up time and allows income growth without physical effort.

- Can supplement or eventually replace earned income.

Limitations:

- Often takes time, capital, or skills to establish.

- It may still require occasional maintenance or oversight.

#3. Portfolio Income (Investment Income)

Income comes from the growth or returns you earn on financial investments like stocks, bonds, or mutual funds.

Examples:

- Capital gains: Selling stocks for more money than you paid for them.

- Dividends: Receiving quarterly payments from shares of a profitable company.

- Mutual fund withdrawals: Gaining returns from SIPs or lump-sum investments.

Advantages:

- Often grows wealth over time through compounding.

- Favorable tax treatment in many countries.

Limitations:

#4. Residual Income

Residual income refers to money earned on an ongoing basis for work completed in the past.

Examples:

- Online course: A teacher creates a course once and earns money each time someone buys it.

- eBooks: Royalties from book sales on platforms like Amazon Kindle.

- Software licenses: A developer earns from selling usage rights repeatedly.

Advantages:

- Long-term earning potential from one-time efforts.

- Scalable model with global reach (especially for digital products).

Limitations:

- Success depends on quality, market demand, and visibility.

- May decline over time without updates or promotion.

#5. Capital Gains Income

Capital gains are profits from selling capital assets like real estate, stocks, or other valuable assets.

Examples:

- Real estate flip: Buying land at ₹20 lakhs and selling it for ₹35 lakhs.

- Stock market: Purchasing shares at ₹500 each and selling them at ₹750.

- Crypto: Earning profit from trading digital assets like Bitcoin.

Short-Term vs. Long-Term Capital Gains:

- Short-Term: Taxed at higher rates, often like earned income.

- Long-Term: Enjoys lower tax rates; encourages long-term investment.

Advantages:

- It can result in high profits with good timing and strategy.

- The government usually taxes long-term gains at a lower rate.

Limitations:

- Subject to market volatility and risk.

- Gains are taxable; losses may be deductible but require tracking and reporting.

- Must consider transaction fees, holding periods, and timing to optimize returns.

#6. Dividend Income

Dividend income is money you earn from a company when it shares part of its profits with its shareholders.

Examples:

- Blue-chip stocks: Companies like TCS, Infosys, or Reliance pay consistent dividends.

- REITs: Real Estate Investment Trusts that distribute earnings from rent collections.

Advantages:

- Regular income without selling assets.

- You can reinvest it to achieve compound growth.

Limitations:

- Dividends are not guaranteed and may fluctuate.

- Subject to taxation depending on the jurisdiction.

#7. Interest Income

Interest income is money earned by lending your money or depositing it in interest-generating instruments.

Examples:

- Fixed deposits (FDs): Banks pay interest for locking in funds.

- Savings account: Though low, banks offer a fixed interest rate.

- Bonds: Government or corporate bonds pay periodic interest to investors.

Advantages:

- Low-risk income stream.

- Suitable for risk-averse individuals and retirees.

Limitations:

- Interest rates may not keep up with inflation.

- Taxable, reducing the effective yield.

#8. Rental Income

You earn rental income by leasing out property, vehicles, or equipment.

Examples:

- Residential units: Monthly rent from tenants.

- Commercial buildings: Leasing office spaces to businesses.

- Equipment rentals: Renting out projectors, cameras, or vehicles.

Advantages:

- A tangible asset with value appreciation.

- Tax benefits through depreciation and deductions.

Limitations:

- Requires capital investment.

- Maintenance, vacancy, and tenant management are ongoing challenges that require constant attention.

#9. Business Income

Profits are generated by running a business, either as an entrepreneur or a silent partner.

Examples:

- Retail store: Earnings after deducting the costs of goods and operations.

- Online store: Net income from product sales through e-commerce platforms.

- Consulting firm: Revenue from offering expert advice.

Advantages:

- High earning potential with scalability.

- Greater control over operations and outcomes.

Limitations:

- High risk and responsibility.

- Time-consuming in the initial stages.

#10. Royalty Income

Royalties are payments given to people who create or own something, like a book or song, when others use it.

Examples:

- Authors: Royalties from published books.

- Musicians: Royalties from streaming platforms like Spotify or Apple Music.

- Software: Licensing custom software to companies.

Advantages:

- Can continue earning even after the initial work is complete.

- You can monetize intellectual property in multiple formats.

Limitations:

- Requires creative or technical output.

- Protection of rights and contracts is essential.

#11. Transfer Income (Government Benefits)

Transfer income is received without a direct exchange of goods or services, often funded by public programs or court orders.

Examples:

- Pensions: Monthly income after retirement from government or private schemes.

- Social welfare: Benefits for unemployment, disability, or low income.

- Scholarships: Educational funds awarded based on merit or need.

Advantages:

- Provides financial support during difficult times.

- Often tax-free or lightly taxed.

Limitations:

- Eligibility may be restrictive.

- Not always reliable or permanent.

Why Understanding Types of Income Matters?

- Smarter Tax Planning: Knowing how each type of income is taxed can help reduce your liability.

- Diversified Earnings: Relying on just a salary is risky. Passive and portfolio incomes offer backup.

- Better Financial Planning: Helps set realistic goals for saving, investing, and retiring.

- Informed Investment Choices: Helps you align investments with your risk tolerance and time.

Final Thoughts

Income is not one-size-fits-all. From working at a job to earning from your investments, from royalties to real estate, your income can take many forms. The more diverse your income sources, the more financially secure you are.

Start by identifying what types of income you currently earn, and explore ways to build additional streams—especially passive and investment incomes—to future-proof your finances.

Recommended Articles

We hope this guide on types of income helps you diversify your earnings and make more informed financial choices. The recommended articles below offer further strategies to strengthen your financial foundation, boost passive income, and grow long-term wealth: